Contents

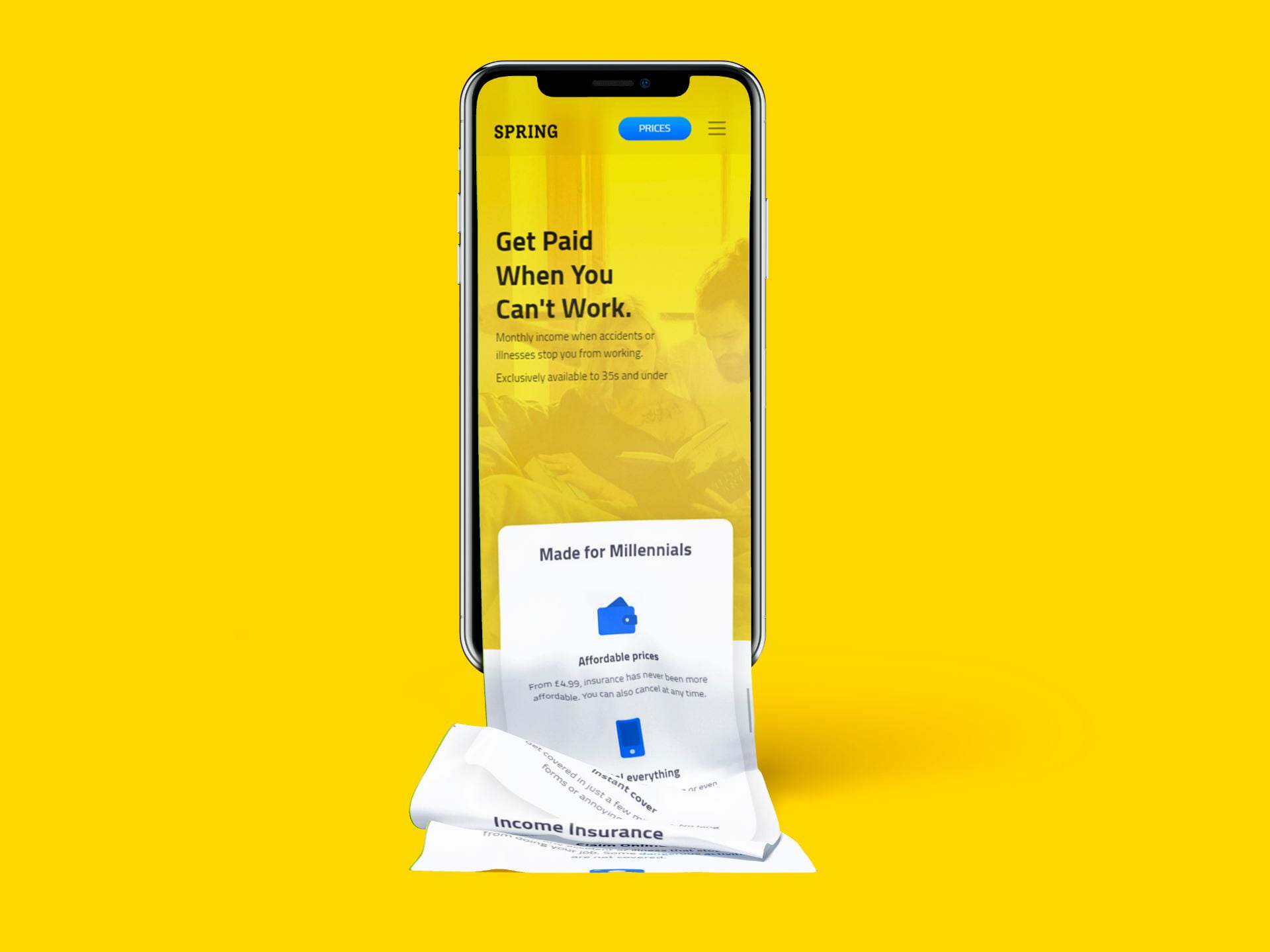

Affordable, Digital and Instant Income Insurance

After finding the process of buying or claiming on insurance incredibly frustrating, Reza Hekmat (Actuarial Science, 2014) felt it was time to bring the system into the digital-age, so it no longer took weeks to complete! With Spring now fully set up, the team have been able to reduce prices, make income insurance affordable, digital and instant, where customers can buy income insurance straight from their phones and in just minutes.

Find out more about Reza here:

Can you tell me about your time at City?

I studied at City for four years from 2010 to 2014 and thoroughly enjoyed my time there. I usually talk about my first year at university as one of the best years of my life. I was at the old Finsbury Halls student accommodations in my first year, which I believe were completely renovated immediately afterward. So, we were the last set of students living in those iconic accommodations. Huge floors with, if I recall correctly, about 20 rooms on each floor. Old and worn out at the time, but I met some of my best friends there and had the best year of my life.

I studied Actuarial Science at the Business School, which gave me a brilliant foundation and opportunities for the rest of my career.

In the academic year 2012-13, I took a placement year and worked at an insurance company called Friends Life (now Aviva) in Bristol. This also gave a huge boost to my experience and career, which I should thank City’s Career Services team for helping set up. I still recommend to everyone to try and get a placement year during their university studies.

What happened after you graduated?

I was fortunate enough to get an actuarial job straight out of university. After finishing my exams, I started working at Vitality, as an actuarial analyst. I worked in the product and pricing team which allowed me to work on some great products alongside brilliant people from across the insurance industry. An experience that is proving to be very valuable now.

I worked at Vitality for five years, qualifying as an Actuary in 2017. I left Vitality in 2019 to work on Spring. Spring is a new provider of insurance, offering affordable, digital, and instant income insurance to millennials.

How did the idea of Spring come about?

We have seen and experienced first-hand, the frustrations that customers go through when buying or claiming for insurance. It was almost impossible to buy income insurance online. It usually involved lengthy phone conversations or filling long forms. In the era of one-click purchases, this really frustrated us.

We have seen and experienced first-hand, the frustrations that customers go through when buying or claiming for insurance. It was almost impossible to buy income insurance online. It usually involved lengthy phone conversations or filling long forms. In the era of one-click purchases, this really frustrated us.

That’s when we decided to set up Spring. At Spring we have created a simple and fully digital journey, where customers can buy and claim for insurance online and in minutes. Also, by cutting out the “middle-man”, manual forms and phone calls, we have managed to reduce the prices and make income insurance affordable.

What have been the biggest challenges?

Starting the company from scratch meant that our biggest challenge was always going to be capital and finding investment. It took us many months, countless coffees, and numerous meetings to find the right investors for our business.

What has been the most rewarding experience?

Learning new skills. Soon after we started Spring, I realised how much more there is for me to learn. I spent the majority of my first few months learning about different aspects of running a business and learning new skills. From programming and compliance, to marketing and even video editing.

Do you have any advice for anyone looking to follow in your footsteps?

I’m still at the beginning of my journey and so may not be best placed to advise anyone. But what I have come to learn is that knowledge and contacts are the two most important assets that anyone can have. I suggest to anyone who wants to start a business or make progress in their career, to learn as many new skills as they can, even if it seems irrelevant to their job at the time, and to make as many connections as possible with the right people.

And to finish off, do you have any other words of wisdom?

Recent events have had an impact on all of our lives and the way we live it. It has made us more aware of our responsibilities towards our hygiene, the environment, and our finances.

And now is the time for us all to take a hard look at the way we conduct ourselves in relation to these and take more responsibility to manage them.

Now that life seems to be returning back to normal, or a new normal, I hope everyone stays safe and look towards the future with enthusiasm and realise that we all have the power to make a difference

Thank you Reza for sharing your success with us! Follow the team on their website, Facebook, Instagram and Twitter.