At Bayes Business School and City, University of London, we are celebrating Black Futures Month, a reimagining of Black History Month, focused on the future of Black excellence, liberation and collective Black joy! As the theme this year is #SalutingOurSisters, we’re highlighting some of our Black alumnae, who have made a huge difference to their communities and contribute to improving the lives of other women.

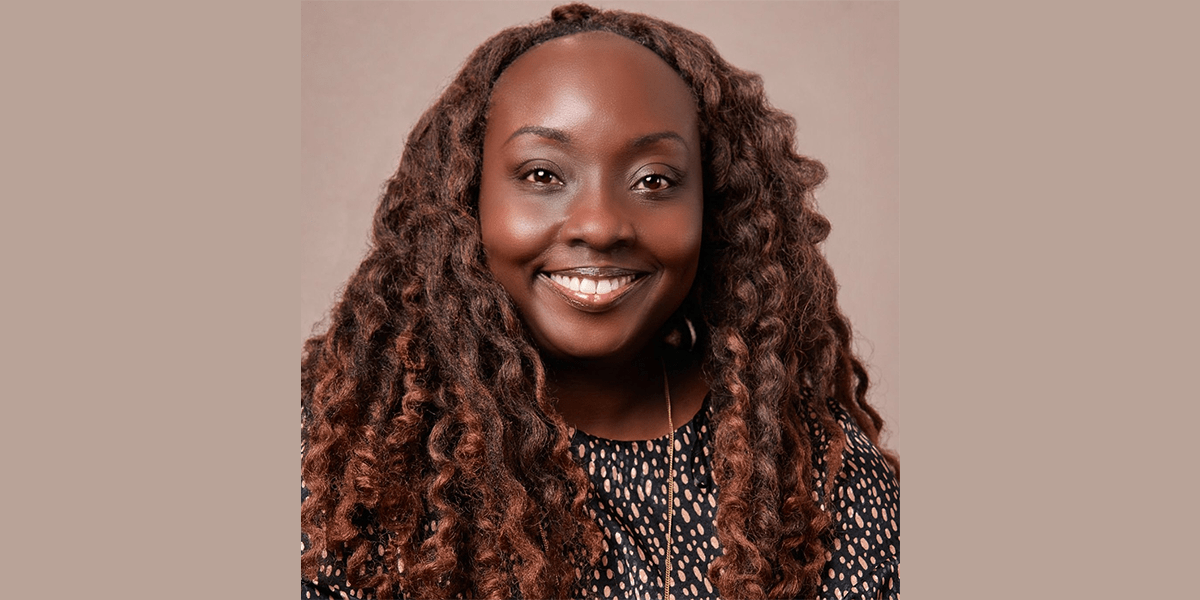

In this conversation with Andia Chakava (MBA, 2011), an investment professional, we discuss her work to empower women, gender lens investing and the importance of diversity across business.

In this conversation with Andia Chakava (MBA, 2011), an investment professional, we discuss her work to empower women, gender lens investing and the importance of diversity across business.

We’d be really interested to learn more about the New Faces New Voices Kenya Chapter and the work you’ve done to empower women in finance and economics.

New Faces New Voices is an organisation that was founded by the Graca Machel Trust to elevate and support women’s leadership and capacity in the financial sector. I was motivated to join and lead it in Kenya from 2012 to provide an enabling environment for women who had leadership positions in the financial sector and like me, craved for a safe space community and network to combat challenges and experiences that were facing them. We were united in purpose to embark on areas where there were gaps and have been able to make remarkable strides on improving women’s representation on boards; advocating for more policies to increase women’s access to finance in the private and public sector; and motivating solutions to put more capital into the hands of women. I have since transitioned out of this role after a ten-year tenure but remain on the Board to support the current Chairperson, trustees and champions meet our new strategic objectives.

As one of the first and youngest woman fund managers in Kenya, you’ve played an instrumental role in setting up new companies and achieved much success in fund management. What has been your inspiration to improve access to entrepreneurship for women in east Africa?

Well despite my education and networks, I still suffer bias when I embark on my work. I therefore imagine how much harder it must be for people that have less access, opportunity and information regarding how to scale their business or obtain the necessary finance that is appropriate for them. I also had the benefit of working for a multi-national for eight years thus deepening my operational efficiency. However, many young people that are starting out into entrepreneurship today do not have that opportunity and have to navigate business challenges in a tough operating economic environment with limited resources. This prompted me to begin to unpack and build relationships with different types of capital providers that can provide both financial and non-financial support for different stages of growth, as well as build the linkages between the demand (women entrepreneurs) and the supply (financial services providers) side respectively to help understand each other’s needs better.

Please could you tell us about gender lens investing and how that impacts your work.

Gender lens investing is using finance as a tool to impact both economic and social change for women and girls. It encompasses moving capital to causes that impact women positively, as well as ensuring that we are deliberate and intentional in sourcing opportunities that can create positive outcomes for women in leadership; advance women’s entrepreneurship; support innovations targeted at underserved segments; and pursue equity in employment. This lens can be integrated with critical global challenges such as climate change to understand the intersection and the impact this has on women or confront it with cutting edge solutions like artificial intelligence that have the potential to redesign the world in a manner that is gender blind.

We aim to contribute to this through our impact investment fund called Afrishela (which means ‘her money’ in Swahili). It seeks to invest in women owned and led enterprises with deal sizes ranging from $20,000 to $500,000 to capture early growth stage businesses, providing capital that is patient and flexible, which is not usually available to this segment. Businesses usually need this catalytic support to survive ‘the valley of death’, as well as to build resilience and ability to absorb more traditional forms of capital.

We know your important work has been recognised on numerous prestigious lists. Do these acknowledgements inspire you to continue improving diversity in investment?

We felt honoured and excited to have our Fund listed under Impact Assets 50 in 2023. It is motivating to have our efforts that seek to integrate our gender lens impact across the investment process acknowledged. For example, the informal economy which we seek to integrate through supply chains can create more regular and predictable income streams. This can support formalisation so they can be counted whilst building a credit history that they can use to support their bankability in future. One of the reasons we unapologetically invest in women-owned and led enterprises is that they organically hire and work with more women. We have also been focused about sensitising entrepreneurs to create opportunities for younger women.

I would now like to channel more efforts to improving the visibility and “investability” of female fund managers of colour and emerging fund managers. Through networks that we are part of, such as advancing women in investments, we advocate and support the challenges for this emerging asset class who are usually locally based and solving grassroot problems impacting their communities.

What do you hope to achieve with your non-executive director roles at 2X Global and East African Educational Publishers?

Being on the Board of 2X Global, which is the global body for gender lens investing, has enabled me to work collaboratively with the global financial services system to make investments more equitable. It also enables me to drive capital to encourage, change or focus behaviour towards investing in opportunities that boost gender equality; create more gendered jobs backed by policies that create an enabling environment for growth and success; and catalyse innovative solutions that promote women’s decision-making ability. It is also a unique opportunity to link intention with accountability through encouraging more members to join the community to sharpen their understanding of key issues and co-create responsive solutions as well as drive accountability through mechanisms like certification.

For East African Educational Publishers, that is our family business and keeps me locally rooted in our cause. Family owned business sometimes do not last from one generation to the next and struggle to attract suitable capital for their needs especially if income is seasonal or dependent on high capitalisation to succeed.

Business, finance and investment, all seem to play a huge role in your career. Is this why you were inspired to study your MBA at Bayes Business School?

I was inspired to do this because London is the global financial capital of the world and I wanted to be in a multi-cultural environment where diversity of thought was encouraged and I would also learn from interacting with others from different backgrounds. It was also post the global financial crisis and I know the first literature regarding governance failures and the lack of women in the boardroom started to come out. It was also a physical manifestation of what a lack of diversity and inclusion can do in decision making and the dangers around group think. I speak about this during my TEDx talk. I also liked the curriculum offered and the “going to office” feel of the Business School, due to its central location and the emphasis on subject matters that I am now working on, such as private equity and governance.

It would be great to learn more about your time at the Business School? Do you have any standout memories?

I really enjoyed the time we went to China. I haven’t been back since but I remember feeling so humbled and in awe of the progress, the rich culture and the diversity in approach and everything was a new experience from the food we ate to the shopping experience.

I also thought our group work activities were interesting. So many team dynamics and learning each other’s work styles and supporting each other through the rigorous programme. I also made some lifelong friends who I still keep in touch with.

Not forgetting the legendary drinks where current students and alumni network and mingle freely. A great way to expand one’s network!

Do you have any advice for others looking to follow in your footsteps?

Believe in yourself; keep learning – it never stops; and always open doors for others. Fear is a good thing – so keep your goals large and ambitious! Be kind, it matters more than you think.

Thank you to Andia for sharing her story and the invaluable work she does to improve the lives of other women.

The information in this story was up to date at the time it was published.